Our Edge

RESEARCH TEMPERAMENT

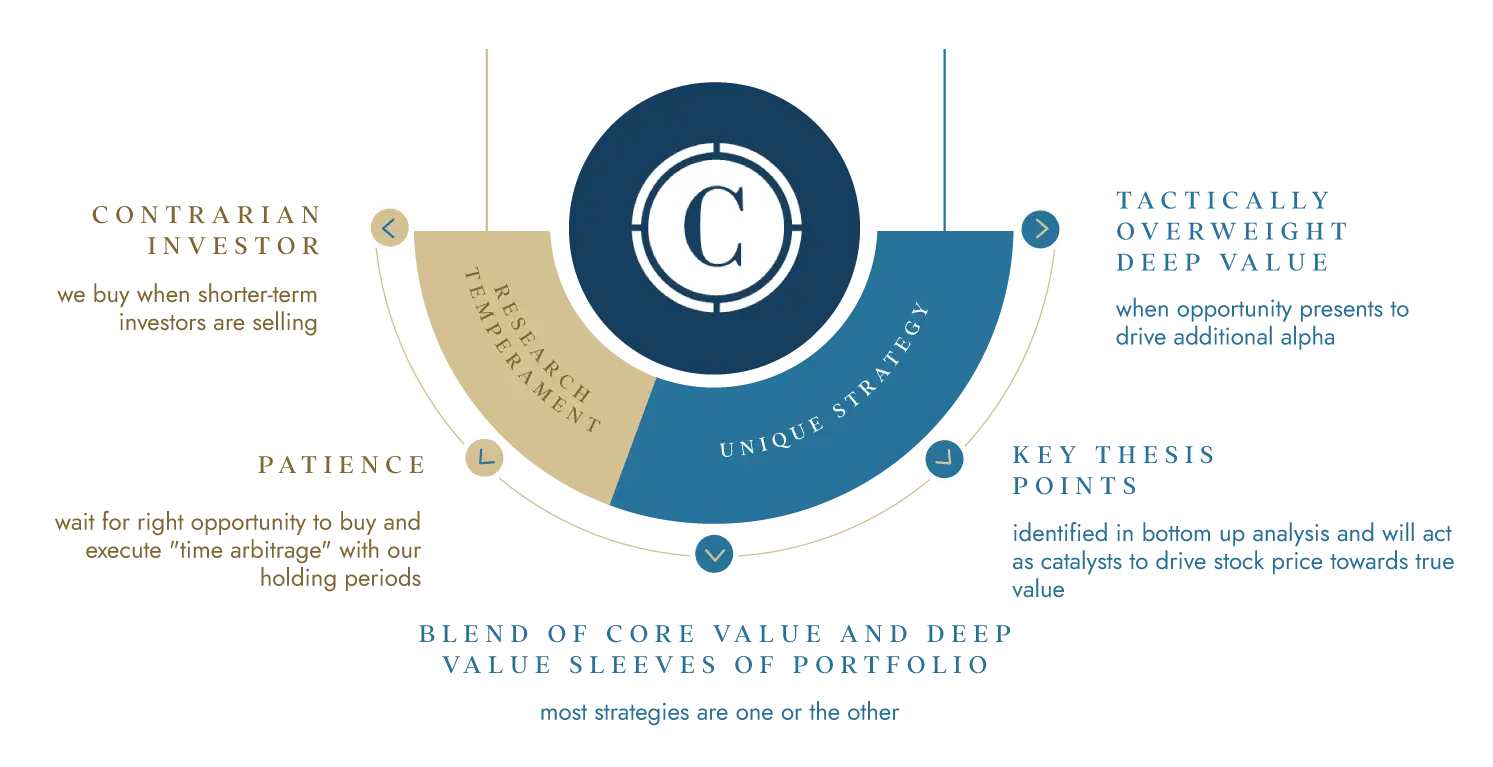

We believe our philosophy to be sound and our strategy unique, but it is only repeatable if research personnel have the right temperament to maintain discipline in volatile markets.

UNIQUE STRATEGY

Manage Your Funds

ALL CAP VALUE

FOCUSED SMALL

CAP VALUE FUND

CLIFFORD

CAPITAL

PARTNERS FUND

FOCUSED SMALL

CAP VALUE FUND

May 14, 2024

Public markets in 1Q24 have been overwhelmed by a strong factor – momentum.

January 24, 2024

2023 was a highly volatile year. It kicked off with the “regional bank crisis” downturn followed by a

May 14, 2024

Public markets in 1Q24 have been overwhelmed by a strong factor – momentum.

November 14, 2023

Over the course of 3Q23 we’ve seen a market environment that has continued to level out.

September 20, 2023

Allocators who invest in value strategies would both want and expect their value manager to perform well in periods

News & Insights

We are committed to a transparent and open partnership with our clients. Get the latest news, knowledge, and thinking from the Clifford Capital Partners team.