Focused Small Cap Value Fund

Institutional Class

TICKER: FSVVX

Fund Overview

OBJECTIVE

The investment objective of the Focused Small Cap Value Fund is long-term capital appreciation.

HIGHLIGHTS

The blend of Core Value and Deep Value companies provides alpha potential with less volatility than a pure deep value strategy

- Core Value: high returns on capital, sustainable competitive advantages, and strong management teams

- Deep Value: negative market sentiment, defensible franchise value, and high expected return potential

INVESTMENT APPROACH

We use a bottom-up approach that seeks to identify businesses where expectations are irrationally low, leading to significant undervaluation, based on our independent research. Both Core Value and Deep Value companies exhibit:

- Strong balance sheets

- Market overreaction short-term events

- Key Thesis Points™ (long-term catalysts) that will improve fundamentals

Primarily invests in companies with market caps of less than $4 billion at the time of purchase.

Concentrated portfolio of 25-35 positions

Quick Look

Total Assets

(all share classes)

$11mm

as of 12/31/2022

Inception Date

10/01/19

CUSIP

98148K128

Primary Benchmark

Russell 2000 Value Index

Minimum Initial Investment

$100,000

Gross Expense Ratio

3.01%

Net Expense Ratio*

1.05%

Availability

Open

*Clifford Capital Partners, LLC (the Adviser) has contractually agreed to reduce fees and/or reimburse certain fund expenses until January 31, 2024.

Investment Team

Morningstar RatingTM,1

as of 12/31/2022

Overall (out of 453 funds)

Morningstar Category Small Cap Value

The Overall Morningstar Rating, a weighted average of the three-, five-, and ten-year (if applicable) ratings, is out of 403 funds in the Small-Cap Value category, based on risk-adjusted return as of December 31st, 2022.

Documents

Performance

Average Annual Total Returns

as of 6/30/21

*Returns for periods of less than one year are not annualized.

Current performance may be lower or higher than the data quoted. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. To obtain the Fund’s performance current to the most recent month-end, please call 800.673.0550. A Fund’s performance, especially for short time periods, should not be the sole factor in making an investment decision.

Performance

Average Annual Total Returns

as of 12/31/2022

1-mo

3-mo

YTD

1-yr

3-yr

Since

Inception

FSVVX

-6.7%

14.7%

-11.4%

5.8%

-

74%

Russel 2000 Value

-6.6%

8.4%

-14.5%

4.7%

-

7.6%

*Returns for periods of less than one year are not annualized.

Current performance may be lower or higher than the data quoted. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. To obtain the Fund’s performance current to the most recent month-end, please call 800.673.0550. A Fund’s performance, especially for short time periods, should not be the sole factor in making an investment decision.

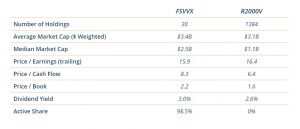

Characteristics

as of 12/31/2022

FSVVX

R2000V

Number of Holdings

30

1383

Average Market Cap ($ Weighted)

$2.2B

$2.4B

Median Market Cap

$1.3B

$0.8B

Price / Earnings (trailing)

12.5

10.1

Price / Cash Flow

7.5

6.0

Price / Book

1.5

0.8

Turnover (LTM)

56.6%

n/a

Active Share

99%

0%

Top 10 Holdings

as of 9/30/2022

% of Net Assets

CVB Financial

4.8%

Winmark

4.6%

NextGen Healthcare

4.6%

Community Trust Bancorp

4.6%

Westamerica Bancorp

4.2%

First Hawaiian

4.0%

Hancock Whitney

3.9%

Perdoceo Education Corp.

3.7%

DXC Technology

3.7%

EVERTEC

3.5%

Portfolio holdings exclude cash and short-term investments. Cash represented 3.5% of the total portfolio. Current and future holdings are subject to change and risk. For a complete list of the Fund’s portfolio securities, call 800.673.0550.

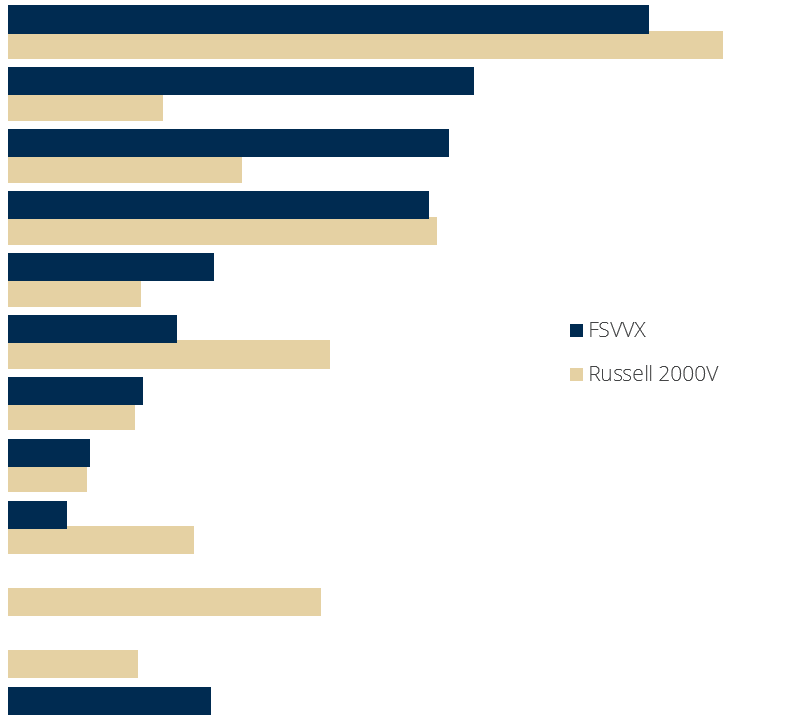

Sector Allocation

as of 6/30/21

Sector

FSVVX

R2000V

Financials

22.7%

25.3%

Information Technology

16.5%

5.5%

Consumer Discretionary

15.6%

8.3%

Industrials

14.9%

15.2%

Materials

7.3%

4.7%

Health Care

6.0%

11.4%

Consumer Staples

4.8%

4.5%

Communication Services

2.9%

2.8%

Energy

2.1%

6.6%

Real Estate

0.0%

11.1%

Utilities

0.0%

4.6%

Cash

7.2%

0.0%

Weights are calculated as a percentage of net assets including cash & cash equivalents

Sector Allocation

as of 12/31/2022

Weights are calculated as a percentage of net assets including cash & cash equivalents. Sector information is based on a representative account as of the date shown and subject to change.

Commentary & Literature

Distribution Date

Distribution NAV

Income

S/T Cap Gain

L/T Cap Gain

Total Per Share

% of NAV

12/30/2022

12/29/2021

12/30/2020

12/30/2019

10.45

12.43

11.53

10.62

0.0396

0.1249

0.1708

0.0062

0.0000

1.0702

0.0000

0.0021

0.5429

0.3690

0.0000

0.0000

0.5825

1.5641

0.1708

0.0083

5.57%

12.58%

1.48%

0.08%

Important Disclosures

For more complete information, please download the fund’s prospectus or call 800.673.0550 for copies. You should consider the fund’s investment objectives, risks, charges, and expenses carefully before you invest. Information about these and other important subjects is in the fund’s prospectus which you should read carefully before investing.