Focused Small Cap Value Strategy

Strategy Overview

HIGHLIGHTS

The blend of Core and Deep Value companies provides alpha potential with a less volatile return stream compared to Deep Value only investors

- Core Value: highest quality, strong return profiles, sustainable competitive advantages, and strong management teams

- Deep Value: negative market sentiment, defensible franchise value, and high expected return potential

INVESTMENT APPROACH

We use a bottom-up approach that seeks to identify businesses where expectations are irrationally low, leading to significant undervaluation, based on our independent research. Both Core and Deep Value companies exhibit:

- Strong balance sheets

- Market overreaction short-term events

- Key Thesis Points™ (long-term catalysts) that will improve fundamentals

Primarily invests in companies with market caps of less than $4 billion at the time of purchase

Concentrated portfolio of 25-35 positions

Quick Look

as of 12/31/2022

Total Assets

Mutual Fund

$11mm

Model Delivery

$27mm

Total

$40mm

Inception Date

04/01/16

Separate Account Minimum

$2mm

Primary Benchmark

Russell 2000 Value Index

Documents

Investment Team

Performance - Average Annual Total Returns

as of 12/31/2022

1-mo

3-mo

YTD

1-yr

3-yr

5-yr

Since

Inception

Focused Small Cap Value Composite (gross)

-6.7%

14.9%

-10.2%

-10.2%

7.0%

4.2%

9.5%

Focused Small Cap Value Composite (net)

-6.8%

14.6%

-10.8%

-10.8%

6.1%

3.3%

8.5%

Russell 2000 Value

-6.6%

8.4%

-14.5%

-14.5%

4.7%

4.1%

8.2%

*Returns for periods less than one year are not annualized

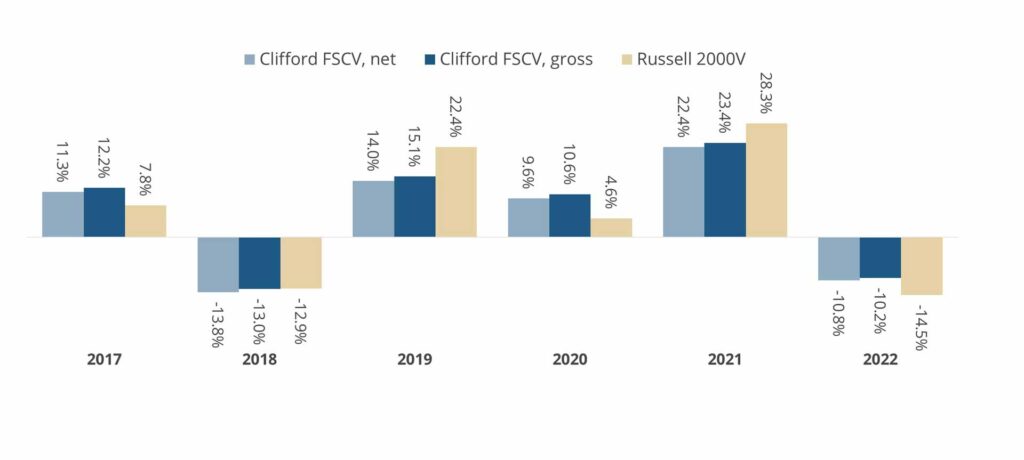

Calendar Year Returns

as of 12/31/22

Portfolio performance and statistics presented are the results of the Clifford Capital Focused Small Cap Value (“FSCV”) Composite. The FSCV Composite combines high-quality (Core Value) stock investments, opportunistic (Deep Value) stock investments and cash. The FSCV Strategy offers exposure to US Value equities of small sized companies (by market capitalization). The inception date for the FSCV Composite is April 1, 2016. Composite returns are shown after the deduction of transaction costs and include the reinvestment of all income including capital gains. Net of fees returns are calculated after the deduction of the actual advisory fees paid by clients. Gross of fees returns do not reflect the deduction of advisory fees. A client’s returns will be reduced by investment advisory fees and other expenses that may be incurred during account management.

The FSCV Composite’s benchmark is the Russell 2000 Value Total Return Index, which tracks the performance of small-capitalization U.S. equities that exhibit value characteristics. The benchmarks may have different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors than the Composites. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance. An index is unmanaged, does not incur fees or expenses, and cannot be invested in directly. Past performance is not indicative of future returns.

Characteristics

as of 6/30/21

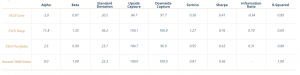

Performance Statistics

as of 12/31/2022 – 5 Year

Alpha

Beta

Standard Deviation

Upside

Capture

Downside

Capture

Sortino

Sharpe

Information

Ratio

R-Squared

FSCV Core

1.5

0.84

21.8

87.0

90.0

0.25

0.18

0.11

0.86

FSCV Deep

-1.0

1.40

39.0

131.1

118.9

0.01

0.00

-0.13

0.73

FSCV Portfolio

0.4

1.01

25.9

98.8

99.2

0.17

0.11

0.01

0.88

Russell 2000 Value

0.0

1.00

24.2

100.0

100.0

0.16

0.12

-

1.00

Statistics definitions found in “Important Disclosures Below.”

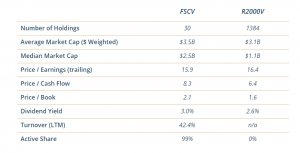

Characteristics

as of 12/31/2022

FSCV

R2000V

Number of Holdings

30

1383

Average Market Cap ($ Weighted)

$2.2B

$2.4B

Median Market Cap

$1.3B

$0.8B

Price / Earnings (trailing)

12.5

10.1

Price / Cash Flow

7.5

6.0

Price / Book

1.5

0.8

Turnover (LTM)

38.9%

n/a

Active Share

99%

0%

Top 10 Holdings

as of 9/30/2022

% of Net Assets

CVB Financial

4.7%

Winmark

4.6%

NextGen Healthcare

4.5%

Community Trust Bancorp

4.5%

Westamerica Bancorp

4.1%

First Hawaiian

4.0%

Hancock Whitney

3.8%

Perdoceo Education

3.7%

DXC Technology

3.7%

EVERTEC

3.5%

Top Ten Holdings only shows securities held and does not include any cash or cash equivalent positions in the portfolio. The holdings information presented is based on a representative portfolio and should not be considered a recommendation to purchase or sell any security. There is no assurance that any securities presented herein will remain in the portfolio at the time you receive information or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any securities transactions or holdings presented were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities presented herein. Other portfolios will vary in composition, characteristics, and will experience different investment results.

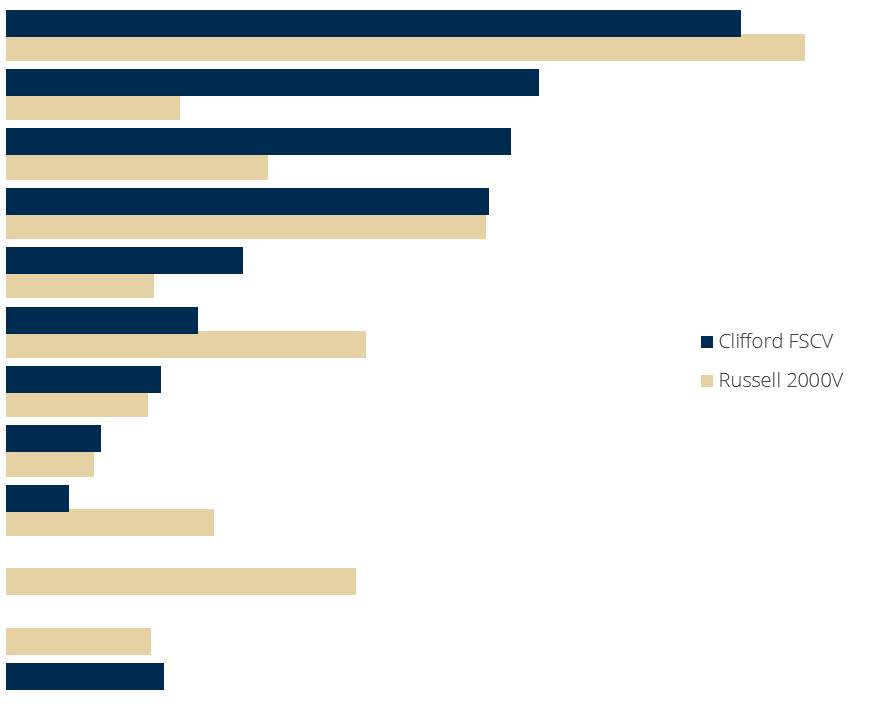

Sector Allocation

as of 6/30/21

Sector

FSCV

R2000V

Financials

23.3%

25.3%

Information Technology

16.9%

5.5%

Consumer Discretionary

16.0%

8.3%

Industrials

15.3%

15.2%

Materials

7.5%

4.7%

Health Care

6.1%

11.4%

Communication Services

4.9%

4.5%

Consumer Staples

3.0%

2.8%

Energy

2.0%

6.6%

Real Estate

0.0%

11.1%

Utilities

0.0%

4.6%

Cash

5.0%

0.0%

Sector Allocation

as of 12/31/2022

Weights are calculated as a percentage of net assets including cash & cash equivalents. Sector information is based on a representative account as of the date shown and subject to change.