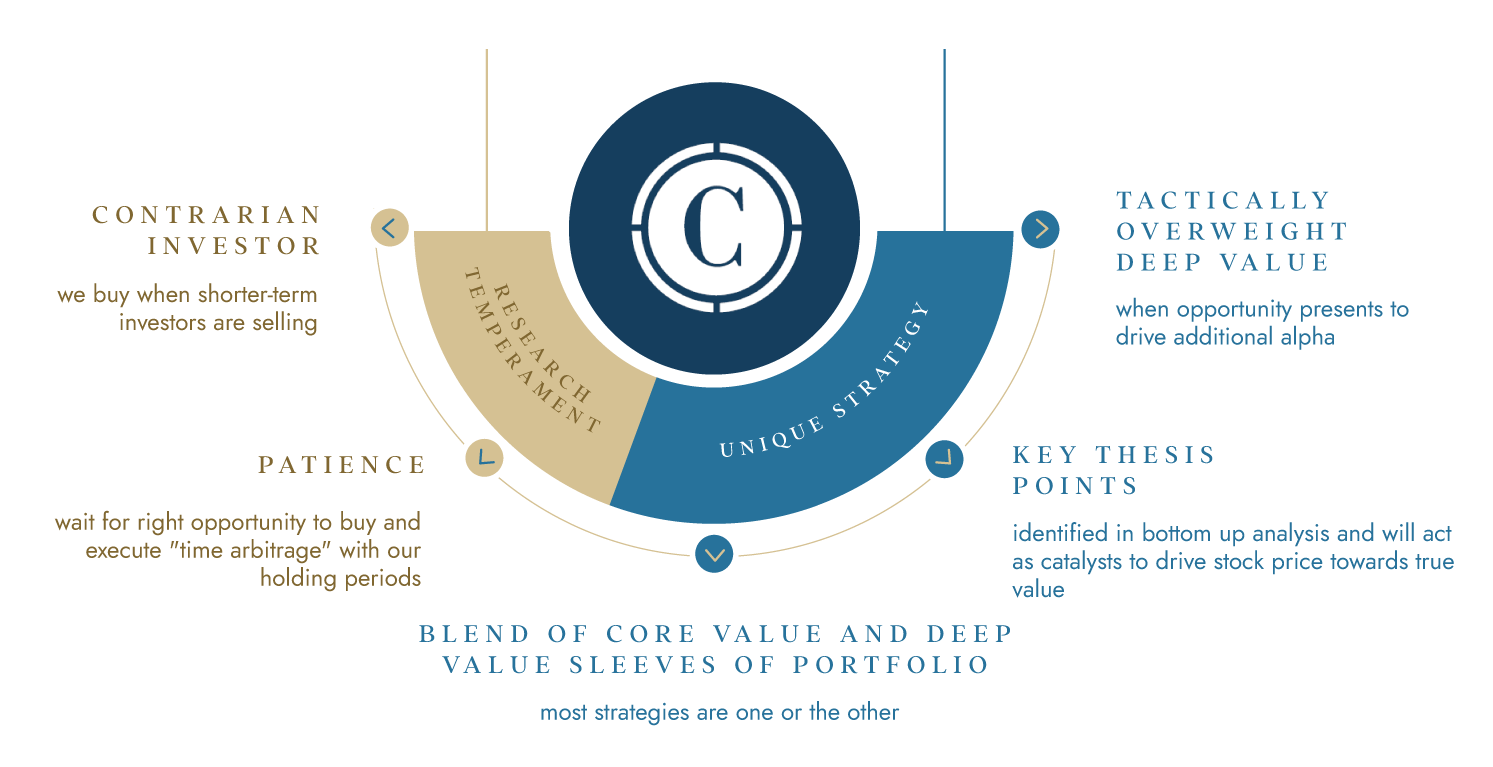

What makes us different

RESEARCH TEMPERAMENT

We believe our philosophy to be sound and our strategy unique, but it is only repeatable if research personnel have the right temperament to maintain discipline in volatile markets.

UNIQUE STRATEGY

Contrarian

Common situations that lead to contrarian buying opportunities

- Overreactions to short-term results

- Fears that cyclical issues are secular

- Prolonged turnarounds/ Wall Street apathy

- Firm or its industry is maturing

- Misunderstood balance sheet or accounting

- Increasing market influence of non- fundamental investors

- Struggling segment overshadowing other strong business lines

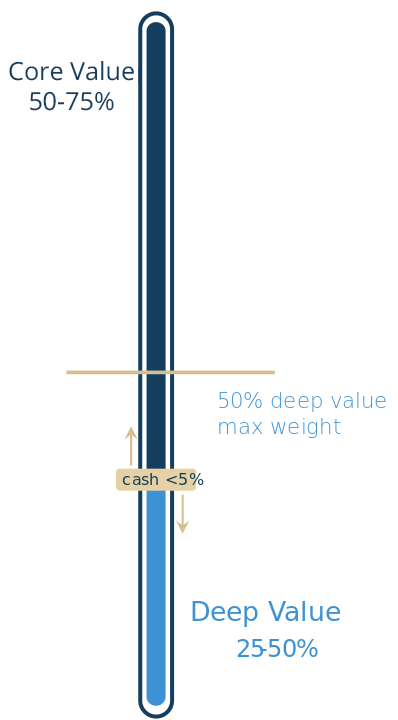

Core Value and Deep Value Sleeves

The strategy is designed so that the weighting of Core Value businesses in the portfolio will always be larger than the more volatile Deep Value companies (Deep Value max weight of 50%)

Core Value companies are wide moat businesses with high returns on capital, sustainable competitive advantages, and strong management teams. We identify them with our proprietary Ten Point Review Process.

Deep Value companies are good businesses with sound balance sheets. We believe that they are simply misunderstood and oversold which presents us with an inefficiency we can exploit for our investors.

Key Thesis PointsTM

The primary objective of our bottom-up research is to identify long-term catalysts which will propel company fundamentals. These Key Thesis Points™:

Identify the most important long-term drivers for each business’ fundamental success

Allow for efficient ongoing portfolio monitoring – focusing on the few things that matter most

Help maintain conviction when short-term noise overwhelms sentiment and stock prices

Allow for quick identification of mistakes – if any Key Thesis Point™ breaks down, the stock is immediately sold

How do we avoid “value traps” or “falling knives?” We believe our ability to identify and monitor Key Thesis Points™ is critical to helping us avoid pitfalls common to the value-oriented investor.

Patience

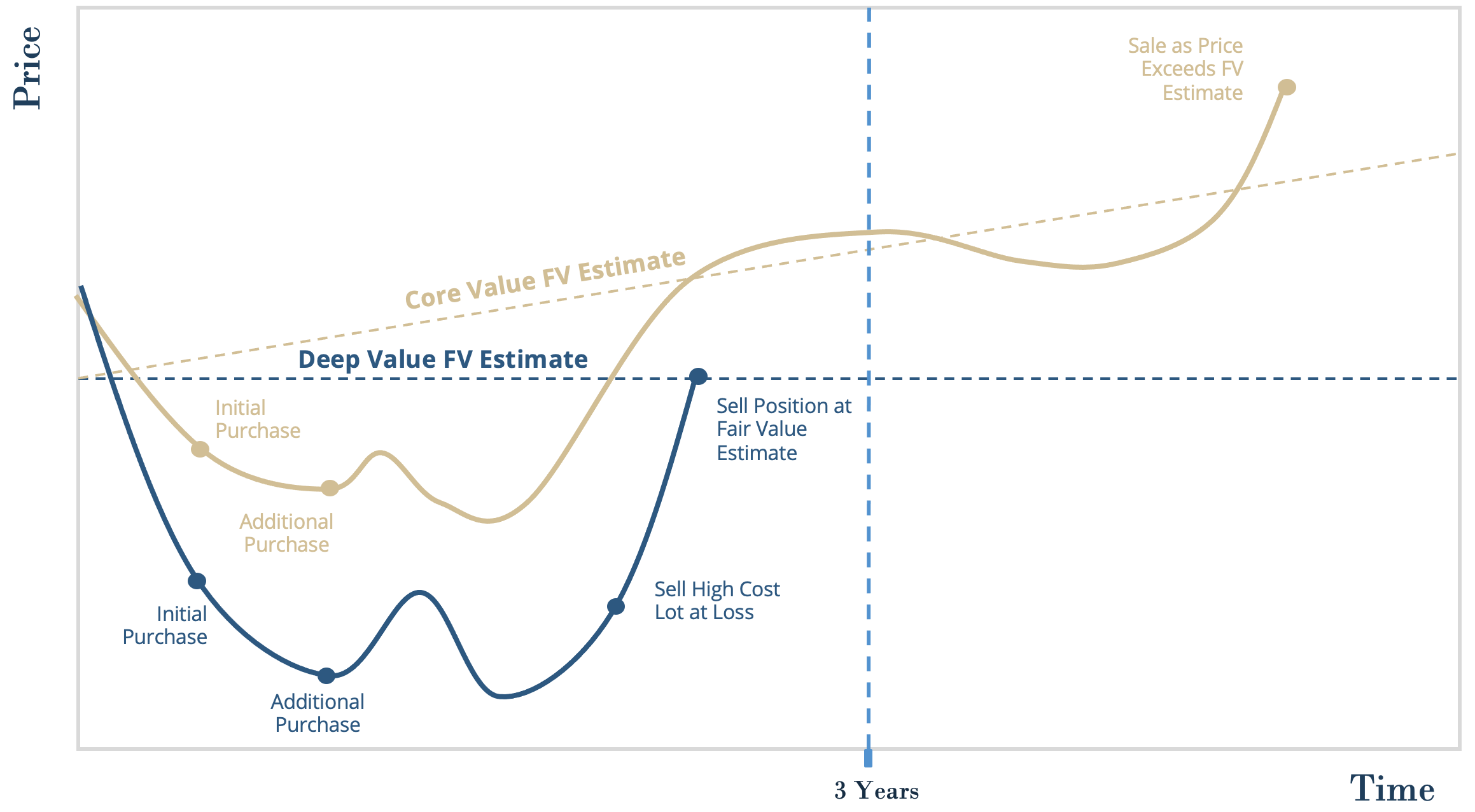

The visual shown above is for illustrative purposes only and does not guarantee a certain level of performance or success. Not all investments will reach or exceed their estimated fair market value. Investors can lose all or part of their money.

Core Value

Deep Value

For Deep Value companies, we allow up to three years for our identified Key Thesis Points™ to drive fundamentals to a point where investors move the stock price to our Fair Value Estimate.

Our low turnover and methodology for implementation leads to a relatively tax-efficient strategy for the taxable investor.

Tactically Overweight

Deep Value

Deep Value Weight Scale

All portfolio weighting decisions are based on the opportunities we see from the bottom up, company by company. There are times we will sell Core Value companies to own better reward/risk opportunities in Deep Value. Opportunistic Deep Value overweighting decisions have added significant returns since inception.

The overall portfolios have delivered market-like beta, a more palatable return stream than most Deep Value only portfolios.

Identifying undervalued securities and other assets is difficult, and there are no assurances that Clifford Capital Partners’ fair value estimates will be accurate or that its strategies will succeed. As with all investing, the potential for profit is accompanied by the risk of loss. Portfolios are concentrated in 25-35 stocks, which can lead to increased short-term volatility; and greater possibility of all or some principal loss. Deep value or out of favor stocks may also increase the potential loss of principal as well as result in greater portfolio volatility as compared to more traditional investment approaches. The prices of common stock fluctuate based on changes in the financial condition of their issuers and on market and economic conditions. Events that have a negative impact on a business probably will be reflected in a decline in the price of its common stock. Furthermore, when the total value of the stock market declines, most common stocks, even those issued by strong companies, likely will decline in value.