Our Mission

Culture

Find Your Genius

A key objective of the firm is to find the “genius” of each team member, regardless of whether it fits the individual’s job description. Team member’s allowed to discover, magnify and exploit natural talent will be more productive in work and passionate about their role.

Freedom to Succeed

As an independent privately held institutional boutique, we actively support the “freedom to succeed” of each team member. Even before Covid-19, our team members had flexible work hours with work from home information technology capabilities to maximize effectiveness while balancing work and personal priorities.

Whether in efforts related to the investment process, client service, operations, public service, or private life, we believe passionate team members will deliver better results for clients.

Together We Are Greater than the Sum of Our Parts

We believe the firm’s team-first humble “all hands on deck” attitude leads to selfless behavior. While each team member prioritizes efforts within specific area of “genius” (specialized expertise and passion), the realities of having a relatively small team require each member to perform multiple duties regardless of individual spheres of responsibility. Working together to achieve superior results is fun and a compelling aspect of firm culture.

Ownership

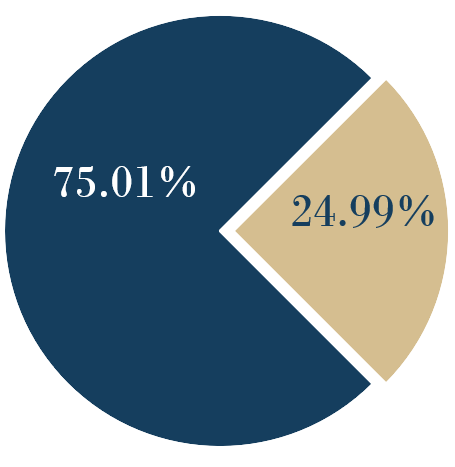

Employee Ownership (75.01%)

Clifford Capital Partners is largely employee owned. We believe that our ownership structure promotes stability and independence that helps us execute our disciplined and repeatable process. All key stakeholders at the firm have equity ownership.

WCM Investment Management (24.99%)

WCM Investment Management shares our high conviction concentrated bottom up philosophy. In 2018, WCM took a passive equity stake in Clifford in exchange for growth capital. The firm provides financial backing, connections, and advice on how to avoid pitfalls that could accompany rapid firm growth. They have been an outstanding partner.

We are independent and

able to think differently

from the pack

Thought

independent/contrarian in investment thought

Geography

remote headquarters “in the mountains” promotes different thinking

Culture

fosters cultivation of “genius” and embodies “freedom to succeed”

Ownership

majority employee owned firm

Philosophy

We believe our philosophy provides a time-tested foundation for our repeatable value investment discipline

Bottom Up

Thorough bottom up due diligence on every holding

Concentrated

Every name in the portfolio matters

High Conviction

Deep understanding of each business and risk

Benchmark Aware

Not benchmark driven

High Active Share

To outperform the benchmark, the portfolio must differ from the market.

Our Process

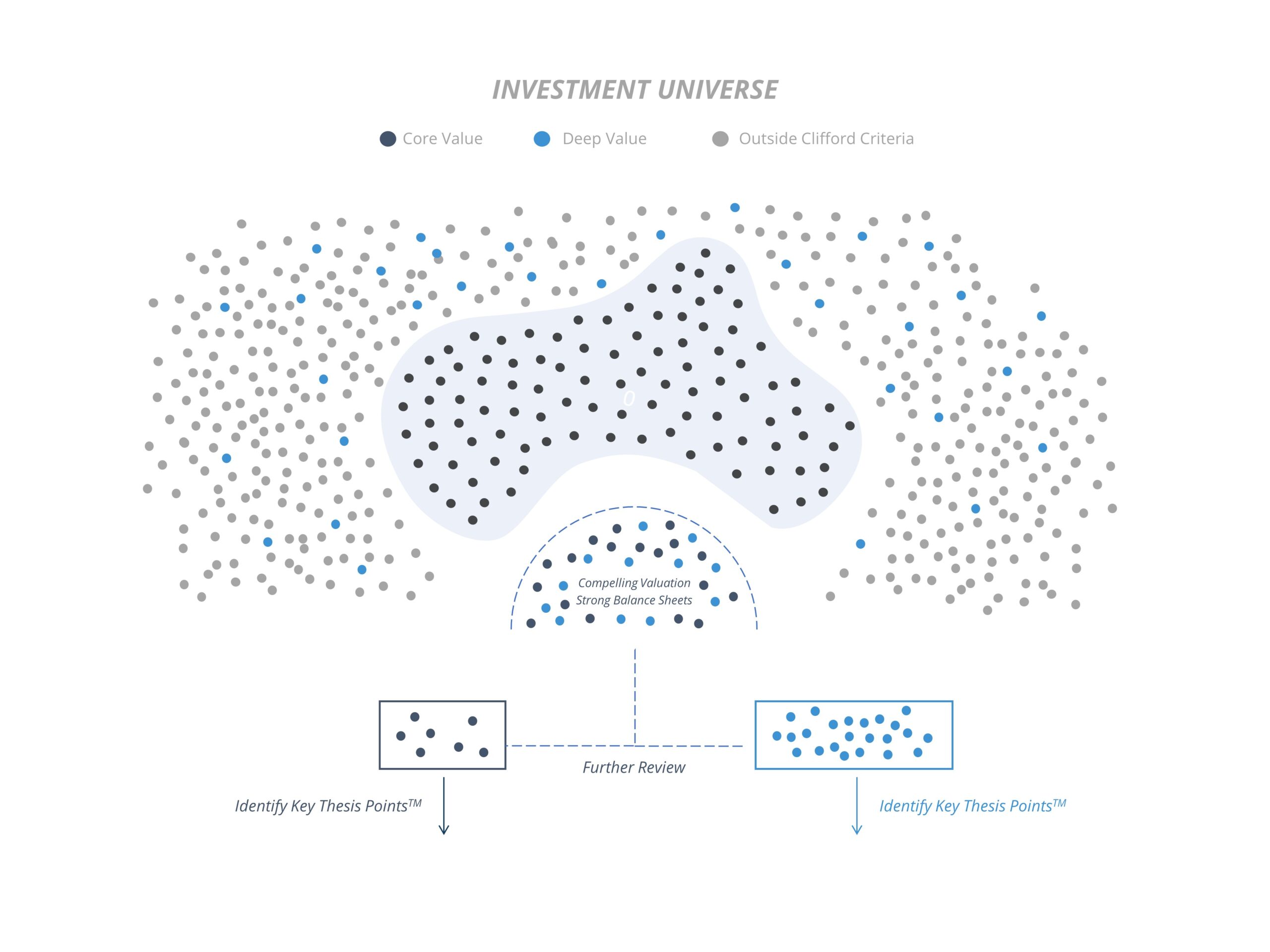

Core Value

Deep Value

- We have pre-identified 100-135 Core Value companies. Core Value business are wide-moat business with high long-term financial return profiles, sustainable competitive advantages, and strong management teams. We identify them with our proprietary Ten Point Review Process.

- When Core Value companies have bad news they are sometimes sold by investors. If a Core Value name falls into our valuation range we put them on our short list for further evaluation.

- If we identify Key Thesis Points™(long-term catalysts) that we believe will improve fundamentals and we think there is a compelling upside/downside ratio, we may purchase the name in the portfolio.

Deep Value

- We constantly scour the market in areas that have been sold off. There are many ways that contrarian opportunities present themselves.

- If a company that reaches our valuation qualification and passes our balance sheet criteria we put it on our “short list” for further evaluation.

- After further review, if we identify Key Thesis Points™(long-term catalysts) that we believe will improve fundamentals and we think there is a compelling upside/downside ratio, we may purchase the name in the portfolio. We seek opportunities with significant upside for the Deep Value Sleeve of the portfolio.

Risk Mitigation

Multiple Risk-Mitigation Disciplines

Our Sell Discipline

Better Idea

We will replace a name for a significantly better reward/risk opportunity.

Trimming

If a position becomes too large or the reward/risk ratio is less favorable, we will likely trim it down.

Change in Thesis

If new information suggests we have made a mistake or Key Thesis Points™ is broken, we will immediately liquidate the position.

Valuation

Deep Value names are sold at fair value estimates. Core Value holdings are sold based on valuation alone only when we believe they are significantly stretched.

Tax Efficiency is a Byproduct of our Disciplined Process

The visual shown above is for illustrative purposes only and does not guarantee a certain level of performance or success. Not all investments will reach or exceed their estimated fair market value. Investors can lose all or part of their money.

Buy & Hold

- Longer holding periods are inherently more tax efficient.

Strategy Implementation

- We maintain a contrarian discipline of buying out of favor stocks. Generally we make a small initial purchase (1-2%) with anticipation of further price declines and additional buying opportunities. Dollar cost averaging produces a variety of tax lots. As stocks rebound toward fair value estimates, higher cost lots offset embedded gains, leading to a more tax efficient portfolio.